Staking Protocols

Validator Insurance

Discover how High Stakes protects delegators against slashing penalties.

Infrastructure

Enterprise RPC & Infrastructure

Get dedicated blockchain connectivity for Enterprise Needs

Staking Protocols

Validator Insurance

Discover how High Stakes protects delegators against slashing penalties.

Infrastructure

Enterprise RPC & Infrastructure

Get dedicated blockchain connectivity for Enterprise Needs

Staking Protocols

Validator Insurance

Discover how High Stakes protects delegators against slashing penalties.

Infrastructure

Enterprise RPC & Infrastructure

Get dedicated blockchain connectivity for Enterprise Needs

Reinventing Equity trading with OPEN

Reinventing Equity trading with OPEN

Reinventing Equity trading with OPEN

•

Feb 8, 2026

For decades, public equity markets have relied on the same centralized infrastructure: custodial brokers, delayed settlement, restricted trading hours, and complex intermediaries like the DTCC (Depository Trust & Clearing Corporation). While digital assets have evolved rapidly, public equities have remained largely unchanged.

Figure Markets is aiming to change that by rebuilding public equity markets directly on blockchain.

About Figure Technology Solutions

Figure Technology Solutions is a blockchain-native financial marketplace built on Provenance Blockchain. It connects the full lifecycle of capital markets, from origination and funding to secondary market trading, all on a single, on-chain infrastructure.

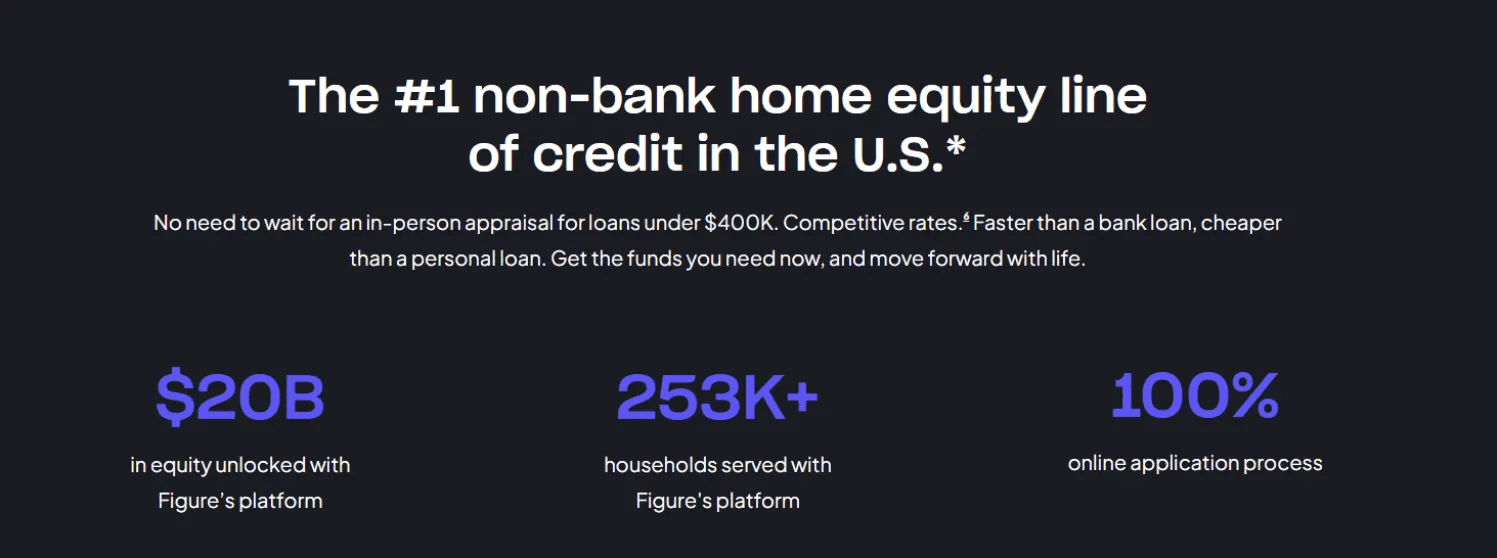

More than 200 partners use Figure’s platform today. Together, Figure and its partners have originated over $19 billion in home equity products, making Figure the largest non-bank provider of home equity financing in the U.S.

Some of Figure’s fastest-growing businesses include:

- Figure Connect, its consumer credit marketplace

- Democratized Prime, an on-chain lending and borrowing marketplace that allows users to unlock liquidity from their assets

Figure’s broader ecosystem also includes:

- DART (Digital Asset Registry Technology), which enables digital asset custody and on-chain collateral and lien registration

- $YLDS, an SEC-registered, yield-bearing stablecoin structured as a regulated investment product

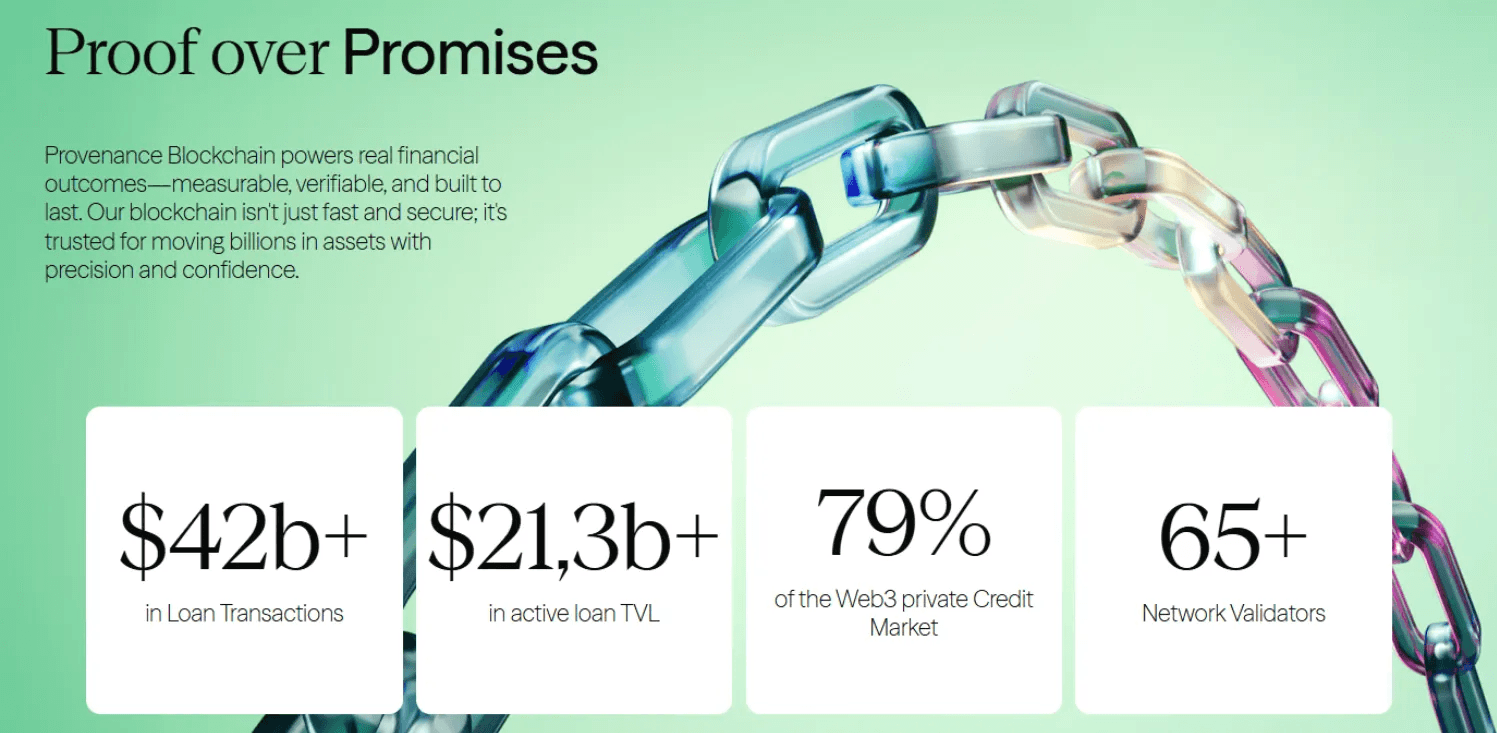

Figure is widely recognized as a market leader in real-world asset (RWA) tokenization. At the core of this ecosystem is Provenance Blockchain, a public, purpose-built blockchain designed specifically for financial services. Unlike general-purpose blockchains, Provenance was created to support real-world assets, regulatory compliance and institutional-grade financial activity.

Figure didn’t just build applications on top of Provenance, but it helped design the network itself. Provenance acts as the shared financial infrastructure that enables:

Secure on-chain asset registration

Real-time settlement

Transparent ownership records

Interoperability between financial products

This foundation is what makes Figure’s next step possible: bringing public equities natively on-chain.

OPEN: a new market structure for Public Equity

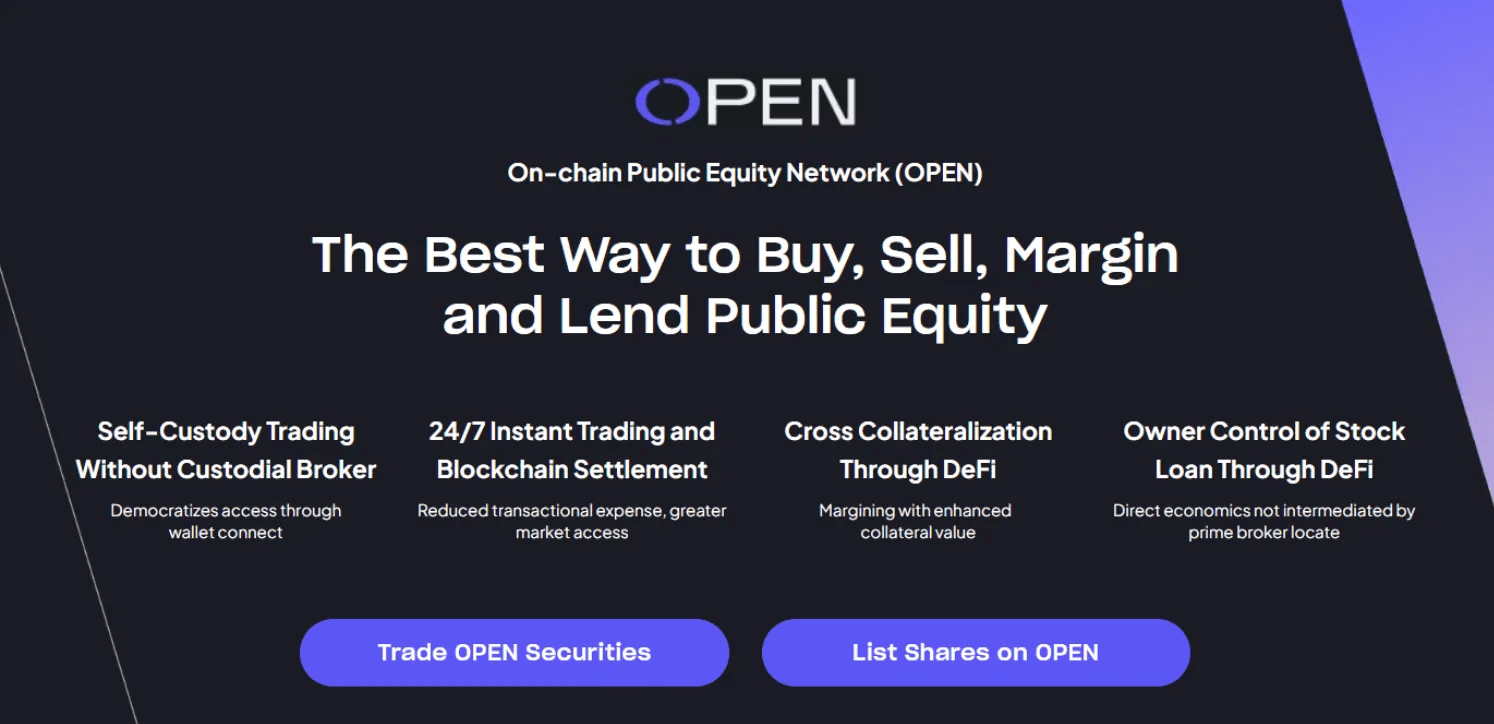

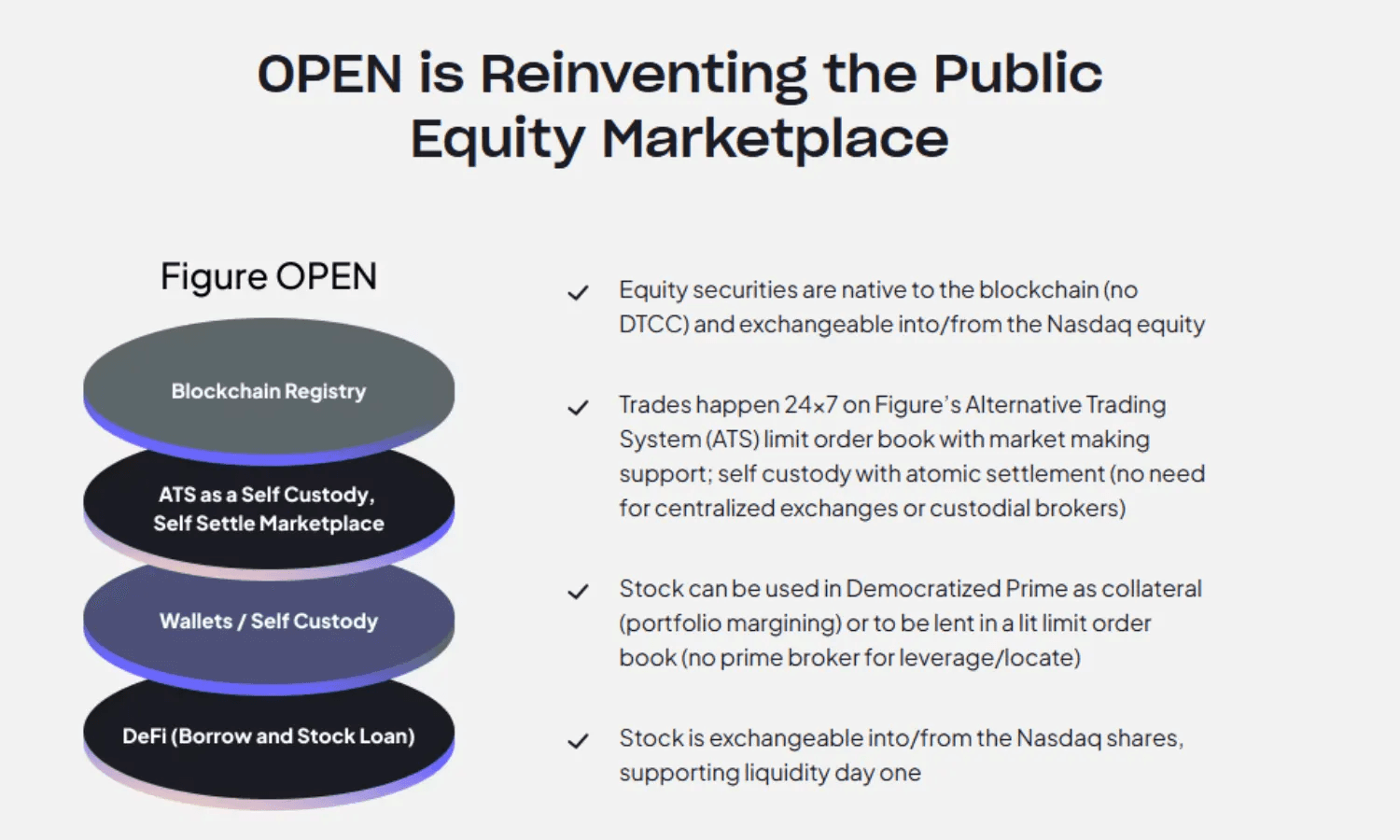

OPEN (On-chain Public Equity Network) represents a fundamental shift in how public equity is issued, traded and owned. Rather than layering blockchain on top of existing market infrastructure, OPEN brings public equities directly onto blockchain from inception. Shares are issued natively on Provenance Blockchain, with ownership, settlement and transfer recorded on-chain.

This distinction matters. Most so-called “tokenized equities” remain dependent on legacy systems such as custodial brokers and centralized clearinghouses. OPEN removes those dependencies entirely, allowing equity securities themselves, not representations of them, to operate in a blockchain-native environment.

This is a major novelty. As Figure’s Executive Chairman Mike Cagney puts it, this is about reinventing equity trading, not just modernizing it.

With OPEN, the full lifecycle of a public equity — issuance, trading, settlement and financing — occurs on-chain. Equities trade through Figure’s regulated Alternative Trading System (ATS) using a familiar limit order book, but with real-time settlement and continuous access.

What Makes OPEN Different for Investors

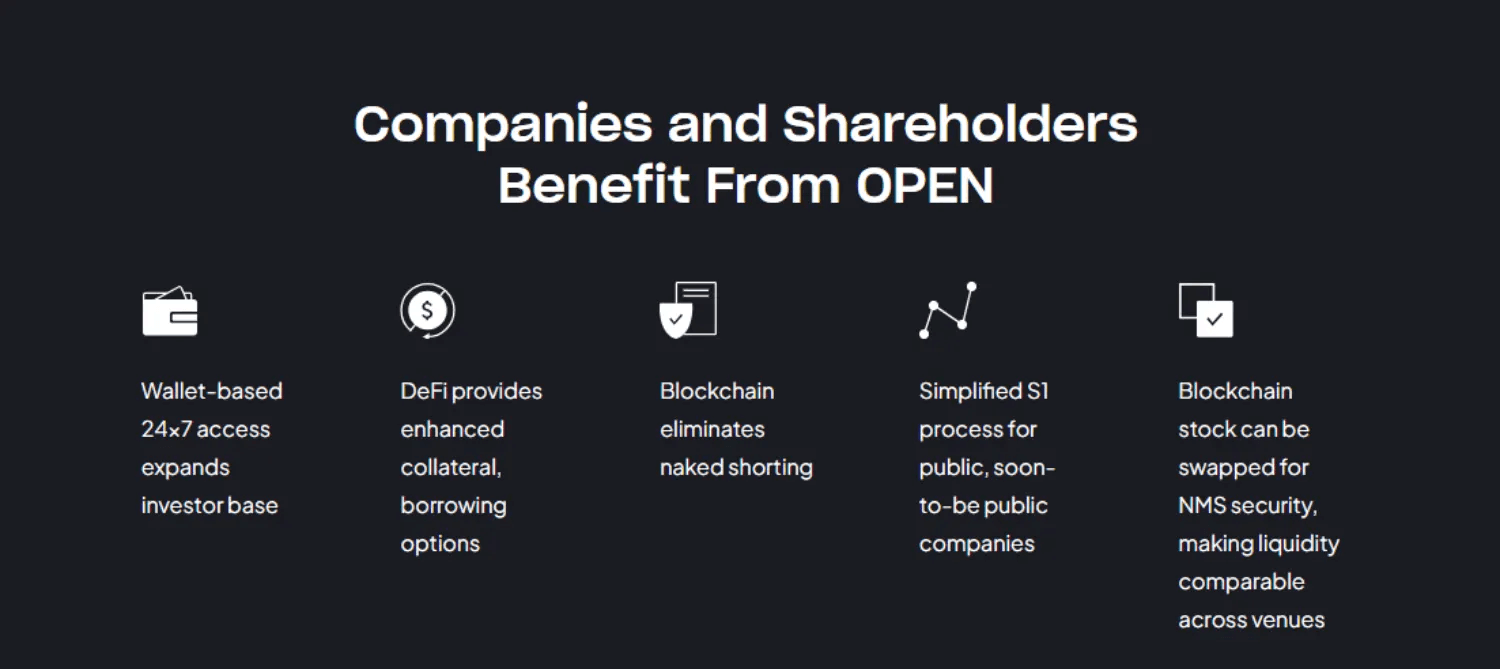

OPEN introduces several changes that fundamentally improve the investor experience:

True ownership, instantly

With on-chain settlement (T+0), investors own their shares the same day they trade them — no waiting days for settlement.24/7 trading

OPEN equities trade through Figure’s regulated Alternative Trading System (ATS) using a familiar limit order book model, but without being limited to traditional market hours.Self-custody and wallet-based access

Investors can trade blockchain-native equities either through regulated brokerage access via moomoo or directly from their own self-custodied walletLower costs and fewer intermediaries

By removing layers like custodial brokers and DTCC processes, OPEN reduces operational costs and friction that are ultimately borne by investors.

Expanding access without compromising regulation

OPEN is designed to expand access to public equities while remaining aligned with existing securities regulations. Investors can access blockchain-native equities through regulated brokerage channels such as moomoo, or through self-custody wallet Keplr, all while maintaining a single, authoritative on-chain record of ownership.

This dual access model demonstrates how public equities can evolve beyond legacy infrastructure without fragmenting liquidity or sacrificing compliance. Whether accessed through a brokerage interface or directly via wallet, the underlying equity remains the same blockchain-native security.

Because OPEN equities live natively on blockchain, they can interact directly with on-chain financial services. Investors can borrow against or lend out their shares through Figure’s Democratized Prime, enabling uses of equity that were traditionally limited to institutional investors and prime brokerage relationships.

This creates new capital efficiency for shareholders, allowing equity to function not only as an investment, but as a productive financial asset within a transparent, on-chain market structure.

——————————————————

OPEN is not an incremental upgrade to existing markets, it is a rethinking of how public equity markets operate at a structural level. With real-time settlement, self-custody ownership, regulated trading and on-chain financing, OPEN lays the groundwork for a public equity market that is more transparent, more accessible and better aligned with the expectations of modern investors.

OPEN brings public equities into the internet era, not as digital wrappers around legacy assets, but as native, continuously settling instruments built for global participation.

Interested? Trade public equities on-chain in five steps:

Open an account → choose custody → fund → trade 24/7 → unlock liquidity from your shares

Get your account ready: the first OPEN issuance is coming soon!

Interested in Staking with Us?

Join 30,000+ other stakers earning optimized rewards with our high-performance validators.

Get started and maximize your staking potential.