Staking Protocols

Validator Insurance

Discover how High Stakes protects delegators against slashing penalties.

Infrastructure

Enterprise RPC & Infrastructure

Get dedicated blockchain connectivity for Enterprise Needs

Staking Protocols

Validator Insurance

Discover how High Stakes protects delegators against slashing penalties.

Infrastructure

Enterprise RPC & Infrastructure

Get dedicated blockchain connectivity for Enterprise Needs

Staking Protocols

Validator Insurance

Discover how High Stakes protects delegators against slashing penalties.

Infrastructure

Enterprise RPC & Infrastructure

Get dedicated blockchain connectivity for Enterprise Needs

Cosmos Network

Staking

Hydro: empowering the Cosmos Hub

Hydro: empowering the Cosmos Hub

Hydro: empowering the Cosmos Hub

•

Jan 5, 2026

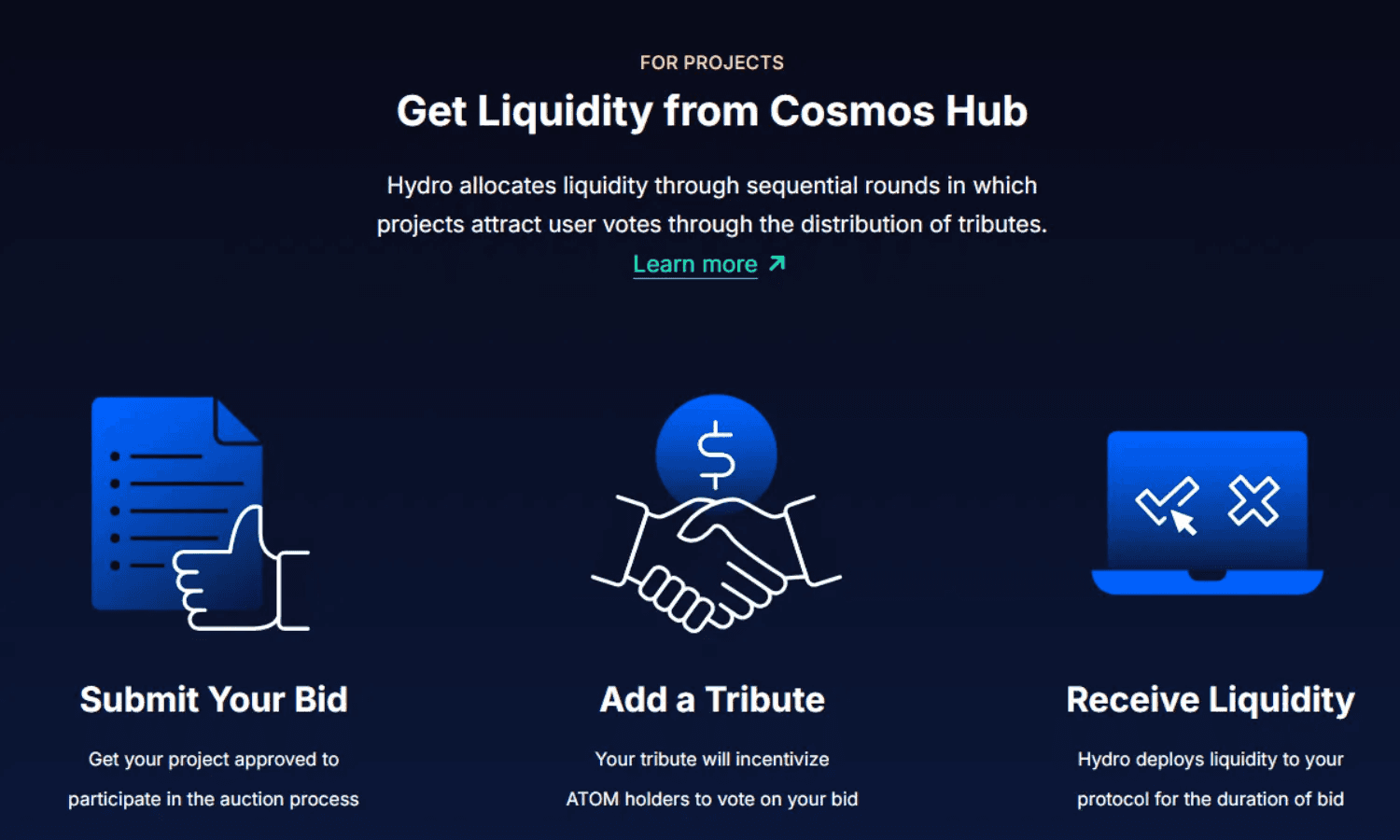

Hydro is a community-driven and decentralized platform that helps the Cosmos ecosystem put its funds to work in a smart, transparent, and responsible way. It allows ATOM holders to lock their tokens to gain voting power and directly influence how shared liquidity is deployed.

Projects can request liquidity by submitting proposals and offering rewards in return, and the community collectively decides which opportunities to support. Once votes are finalized, Hydro’s automated system safely deploys the funds and distributes the rewards back to participants. Operating under Cosmos Hub governance oversight, Hydro has already deployed millions of ATOM across more than 20 Cosmos-based protocols while preserving 100% of the original capital.

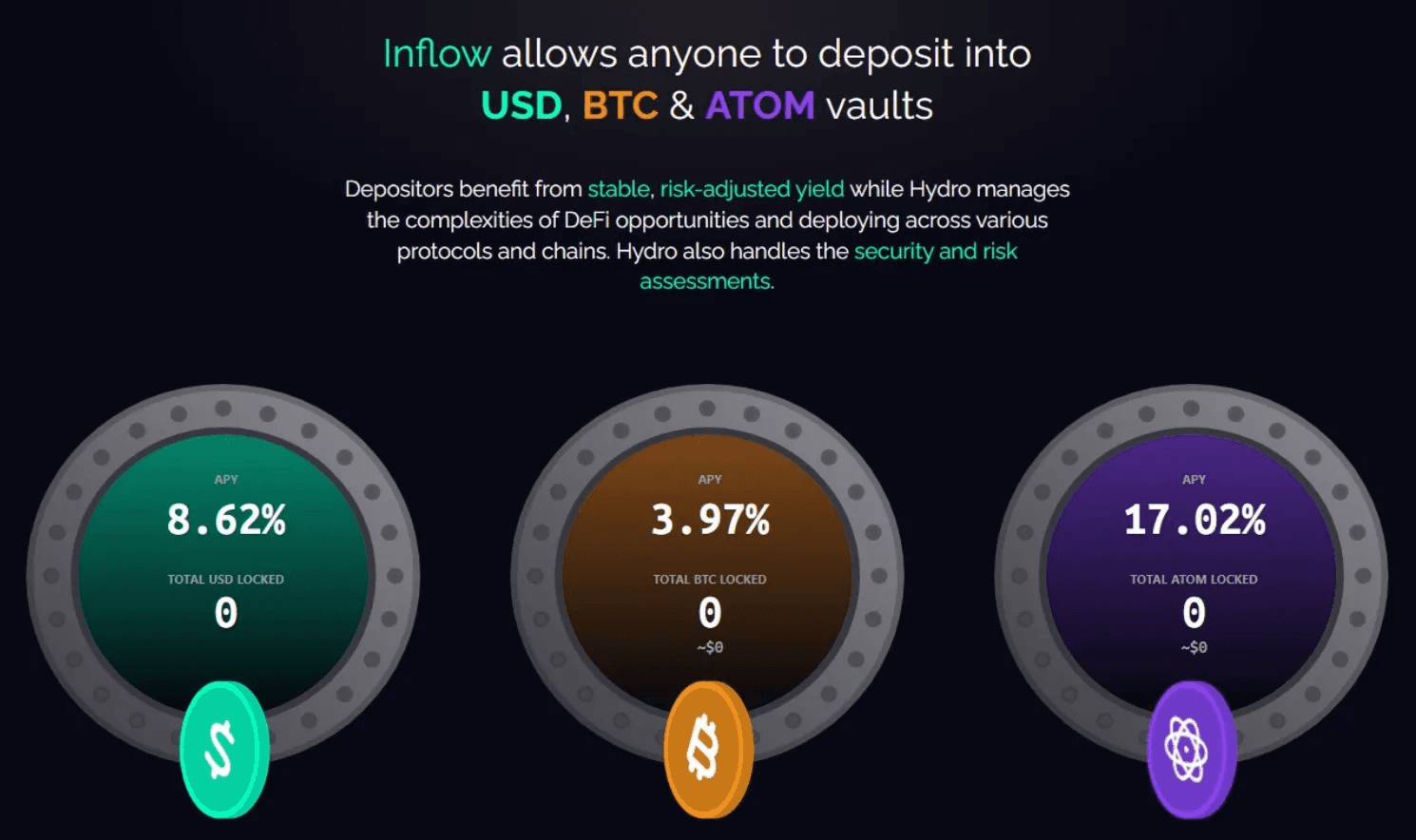

With the launch of its Inflow vaults (ATOM, BTC & USD), Hydro extends these capabilities even further by simplifying yield generation across both Cosmos and Ethereum-compatible ecosystems, all while remaining secure, efficient and community-led.

Why Hydro matters for the Cosmos Hub?

The Cosmos Hub holds one of the largest community treasuries in the blockchain ecosystem, denominated in ATOM, its native token. A significant portion of these funds currently remains idle, generating little to no value for the network.

Hydro is a designed to solve this inefficiency by deploying ATOM into low-risk, yield-generating strategies while preserving capital. A new governance proposal suggests allocating 7 million ATOM from the Cosmos Hub community pool into Hydro’s ATOM Inflow vault, marking one of the most ambitious efforts to put community funds to productive use.

This initiative combines treasury management, DeFi infrastructure, liquid staking and long-term token value accrual into a single, integrated strategy.

A zero-fee, Hub-native ATOM Liquid Staking Token (LST)

Hydro is developing an ATOM Liquid Staking Token designed to give ATOM holders the highest possible staking returns while keeping their capital flexible and usable across DeFi. A Liquid Staking Token represents staked ATOM but remains transferable, allowing users to earn staking rewards without locking their tokens. Unlike traditional staking, where rewards are periodically claimed and increase the number of tokens held, an LST increases in value over time without increasing token count.

Hydro’s LST will be fully compatible with Cosmos Hub governance, allowing holders to participate in on-chain voting even while their ATOM is deployed in DeFi. This feature is especially important for institutional stakers, who can earn yield, remain liquid and still take part in governance. The LST will also be designed for broad DeFi integration, expanding beyond Cosmos into EVM-compatible ecosystems through partnerships and cross-chain deployments.

Most existing ATOM LSTs charge around 10% of staking rewards as protocol fees. Hydro’s LST will charge 0%, meaning:

Higher effective returns for stakers

Strong long-term compounding benefits

Increased competitiveness against existing LSTs

With current ATOM staking rewards near 17% annually, this translates into meaningfully higher returns that compound over time — resulting in significantly more ATOM compared to fee-based alternatives over the long term (e.g. stATOM, dATOM which have charged a 10% fee on staking yield).

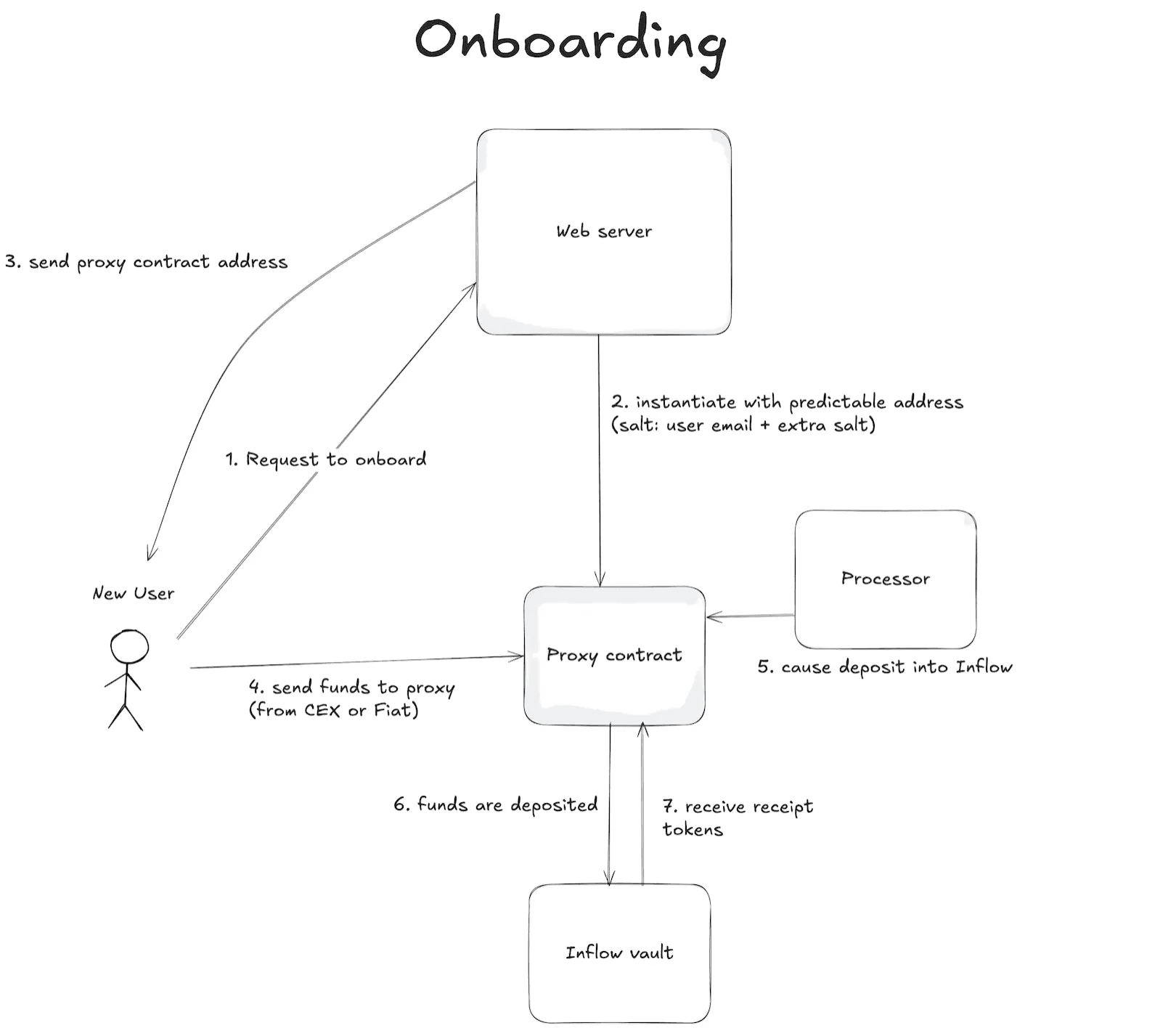

Accessibility is another major focus. Hydro will enable users on centralized exchanges to access the LST without needing to create a self-custody wallet. Through its integration with WAVS, users who buy and stake ATOM on an exchange will be able to transfer into the LST and immediately earn higher yields. This approach encourages more ATOM to be staked with community validators and actively participate in governance, rather than remaining passive on exchange-run validators. Hydro also plans to onboard completely new users through simple fiat on-ramps, such as bank transfers or credit cards, significantly expanding ATOM’s potential user base.

Peg stability is a critical component of the LST’s design. The “peg” refers to the LST’s target value relative to the ATOM it represents — typically close to one ATOM plus accrued staking rewards. Maintaining this peg ensures that the LST can be reliably redeemed for underlying ATOM. To protect it, Hydro will implement minting limits, liquidity buffers and tiered controls that restrict minting if liquidity becomes insufficient. The Inflow ATOM vault will further support the peg by providing liquidity and performing automated arbitrage during periods of market stress.

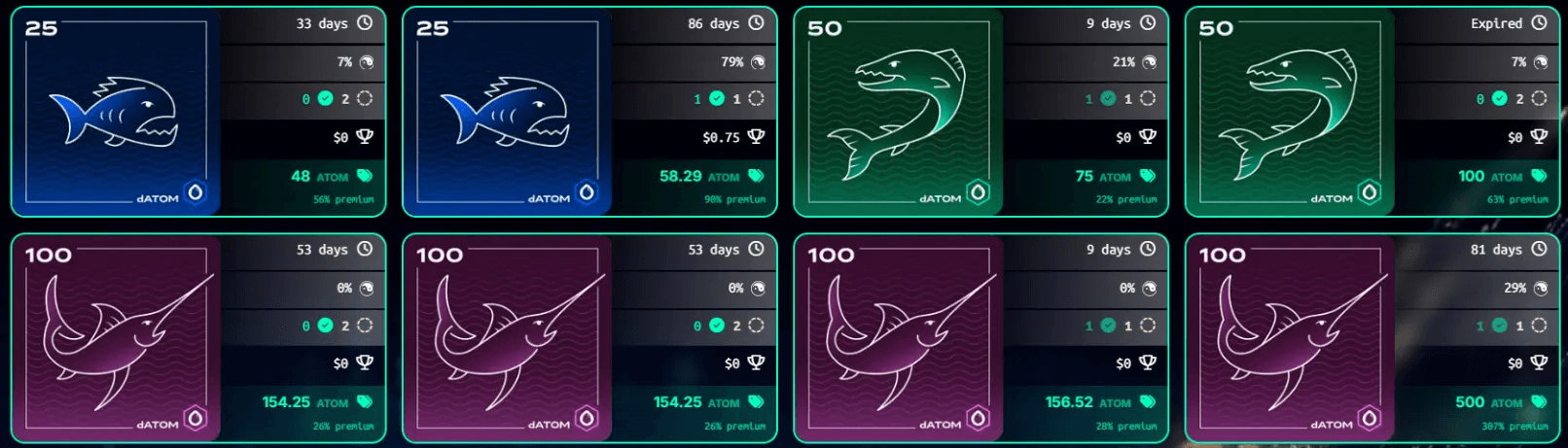

For existing dATOM holders, Hydro aims to provide a smooth and respectful transition if it takes over dATOM as the foundation for the new LST. This would include a seamless migration process and recognition of early Drop protocol participants. Droplet points could be redeemed either by minting a Hydro lockup NFT that determines a share of future yield, or through a one-time distribution of the remaining revenue generated by Drop since its launch.

Hydro’s LST is designed with institutional investors in mind, while remaining open to retail users.

Governance participation while in DeFi: LST holders can vote on Cosmos Hub proposals even while their ATOM are deployed in DeFi. Votes are aggregated and cast on-chain through the LST smart contract.

Tax efficiency: unlike regular staking, where rewards are claimed and token balances increase, LSTs grow in value without increasing token count. In many tax jurisdictions, this enables automatic compounding without triggering ongoing taxable events, which this LST will also support.

High security standards: the protocol uses Quint, a formal specification language developed by Informal Systems, to mathematically verify critical system rules such as one-to-one backing and redemption logic.

Hydro gives ATOM holders a front-row seat to new and emerging projects in the Cosmos ecosystem. Participants are highly engaged and can vote on where liquidity is deployed, making them some of the most active users in the network. Many projects recognize this and choose to reward Hydro lockers with airdrops of their tokens. The Hydro team stays in close contact with these projects to help ensure Hydro participants are included in upcoming opportunities. Users can also easily track which projects are planning airdrops through Hydro’s airdrop project list, giving them a clear view of where new ecosystem opportunities are emerging.

The Inflow Vault and LST integration

The ATOM Inflow vault is Hydro’s flagship yield product and a key extension of its Liquid Staking Token (LST). It acts as a simple gateway for ATOM holders to earn additional, non-inflationary yield without having to actively manage complex DeFi strategies themselves.

The ATOM Inflow vault is built around a simple idea: generate steady yield while protecting users’ capital.

Low-risk and delta-neutral strategies designed to minimize exposure to market price volatility. For users who want higher potential returns, Hydro also offers the Riptide feature, which provides access to more market-exposed strategies while insuring deposits against losses.

Layered yield approach: base yield comes from ATOM staking, with additional yield from arbitrage, lending and derivatives strategies.

Multi-chain deployment: capital can be deployed across Cosmos and EVM-based ecosystems.

(Upcoming) Flexible liquidity options: users can choose lock durations (1 day, 24 days, or 90 days), with longer locks earning higher yields.

In exchange, users receive a vault share token that represents their deposit and lets them track performance through a transparent dashboard showing exactly how funds are being used. These vault shares can be switched between lock durations or converted back into the native LST when users want to exit, making it easy to balance liquidity and returns. Over time, Hydro plans to support these vault share tokens across DeFi, allowing them to be used as collateral and further improving capital efficiency.

—————————————

Hydro is especially compelling in the context of Cosmos Labs’ new roadmap. As Cosmos shifts its focus toward institutional infrastructure, enterprise adoption and sustainable revenue generation, Hydro naturally fits into this direction by turning ATOM into productive, yield-generating capital. While Cosmos Labs builds the foundations institutions need — customizable chains, governance frameworks and compliant infrastructure — Hydro ensures that liquidity, yield and DeFi activity continue to flow through the Hub. This helps connect institutional growth back to the broader ecosystem instead of isolating it within disconnected enterprise chains.

By migrating to the Hub, deploying capital responsibly, and supporting both institutional and community use cases, Hydro will reinforce the Hub’s role as the connective tissue of Cosmos. It will enables ATOM holders to benefit through non-inflationary yield, deeper liquidity and increased on-chain activity, while giving institutions the tools they need to participate without sacrificing governance or capital efficiency. In that sense, Hydro is not just compatible with Cosmos’ new direction — it is a practical execution layer that helps translate the roadmap into tangible value for ATOM and the wider Cosmos ecosystem.

Interested in Staking with Us?

Join 30,000+ other stakers earning optimized rewards with our high-performance validators.

Get started and maximize your staking potential.